Max Sep Ira Contribution 2025

BlogMax Sep Ira Contribution 2025 - Max Sep Ira Contribution 2025. Individuals under 50 years of age have a $16,000 annual contribution limit in 2025, while those aged 50 or older can invest up to $19,500 in their simple ira. These contribution limits reflect the 2023 tax year and. SEP IRA The Best SelfEmployed Retirement Account?, This limit is an increase from the 2023. These contribution limits reflect the 2023 tax year and.

Max Sep Ira Contribution 2025. Individuals under 50 years of age have a $16,000 annual contribution limit in 2025, while those aged 50 or older can invest up to $19,500 in their simple ira. These contribution limits reflect the 2023 tax year and.

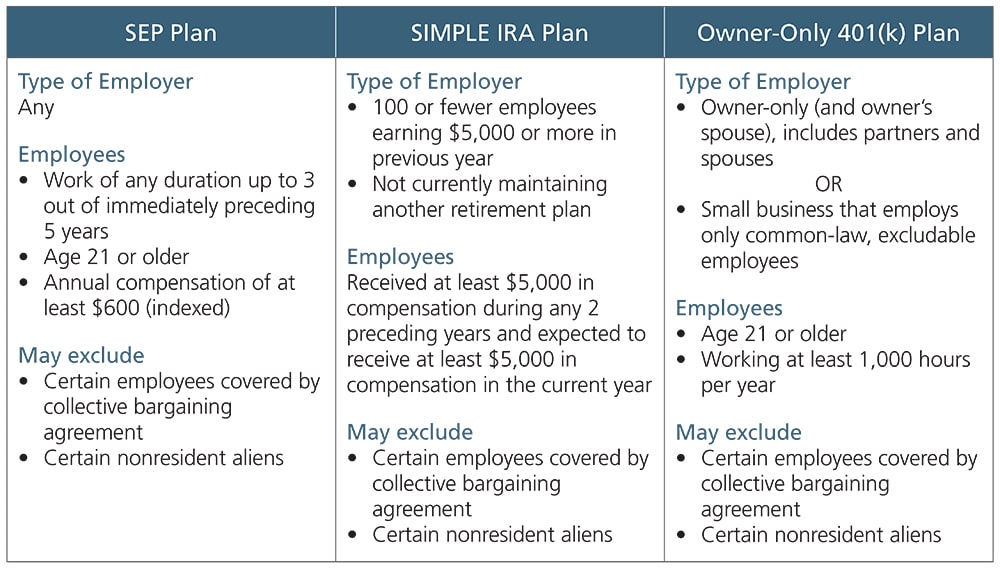

IRA Contribution Limits in 2023 Meld Financial, A good option for small business owners, sep iras allow individual annual contributions of as much as. If less, your taxable compensation for the year.

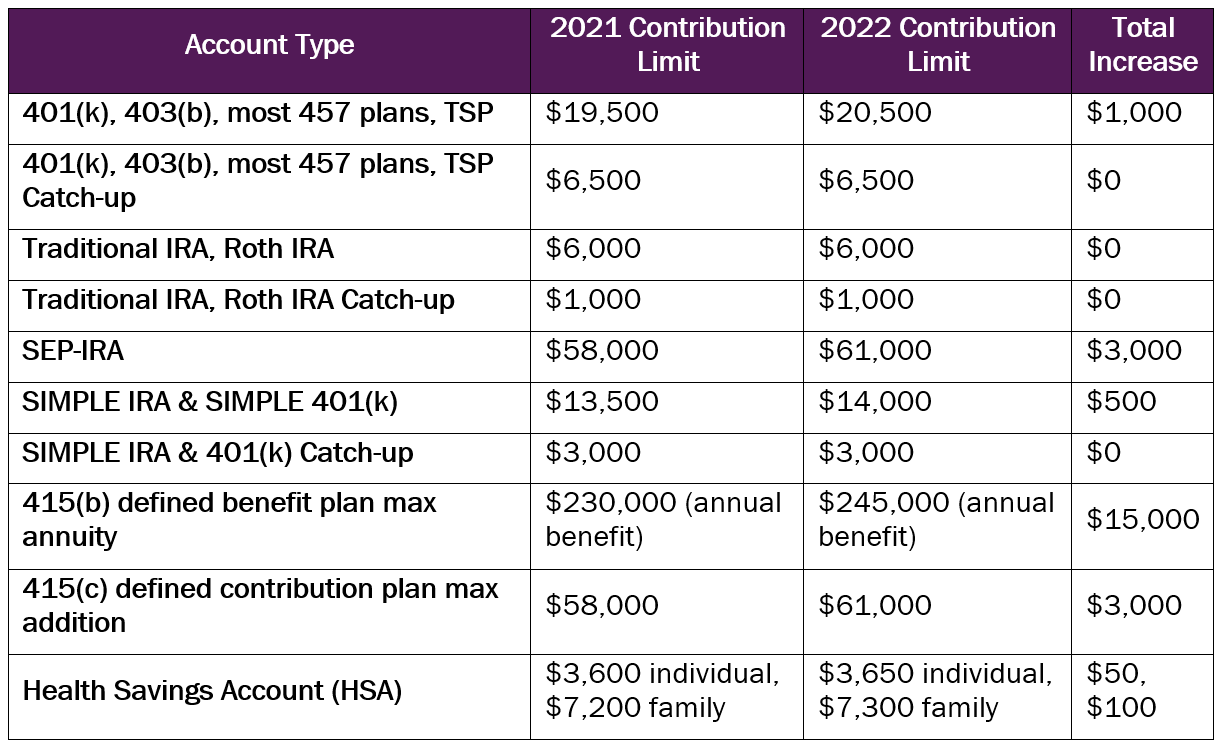

Each account type has caps on how much you can put into them each year that can vary depending on the type of plan.

2025 RETIREMENT ACCOUNT CONTRIBUTION LIMITS ANNOUNCED — Day Hagan, The maximum contribution for the 2025 tax year is $7,000 a year. $66,000 (in 2023), or $69,000 (in 2025) the sep ira is an employer contribution rather than an employee contribution, so it’s made by the company rather than the individual.

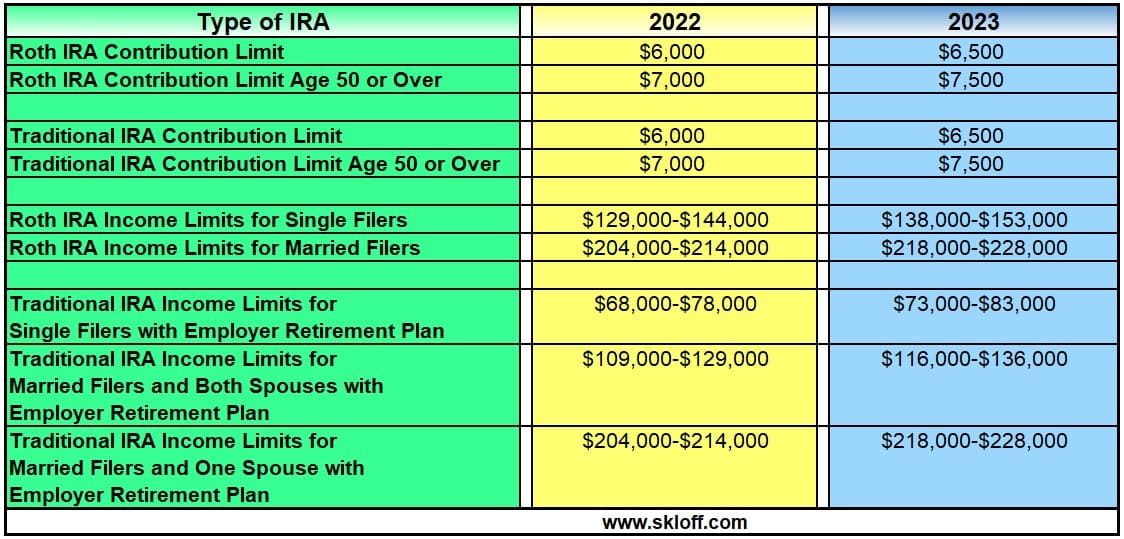

Roth IRA Limits And Maximum Contribution For 2025, Morgan professional to begin planning your 2025. The limit for owners is the lesser of 20% of net.

What Are the IRA Contribution and Limits for 2025 and 2023? 02, The sep ira contribution limit for 2023 is 25% of eligible employee compensation, up to $66,000. If less, your taxable compensation for the year.

simple ira contribution limits 2025 Choosing Your Gold IRA, Retirement plan contribution limits for 2025. Most workers can set aside up to $7,000 to one of these accounts in 2025 if they're under 50 or $8,000.

The maximum contribution for the 2025 tax year is $7,000 a year.

Features sep ira contribution limits for 2025. $6,000 ($7,000 if you’re age 50 or older), or.

Irs Rmd Table For 401k Matttroy, Washington — the internal revenue service announced today that the amount individuals can contribute to their 401 (k) plans in 2025 has. What are the sep ira contribution limits for 2025 and 2023?

SEP IRA Contribution Limits with Calculator for Self Employed Persons, Sep ira contribution limits for 2023. Each account type has caps on how much you can put into them each year that can vary depending on the type of plan.